are funeral expenses tax deductible in ontario

Instead you can email mvacfmcsontarioca to serve submit copies of legal documents and you can make payments to the fund online. Most insurance plans for Super Visa are for medical emergencies only.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1252668563-856e547ad95a4df790cdc1d4432004a2.jpg)

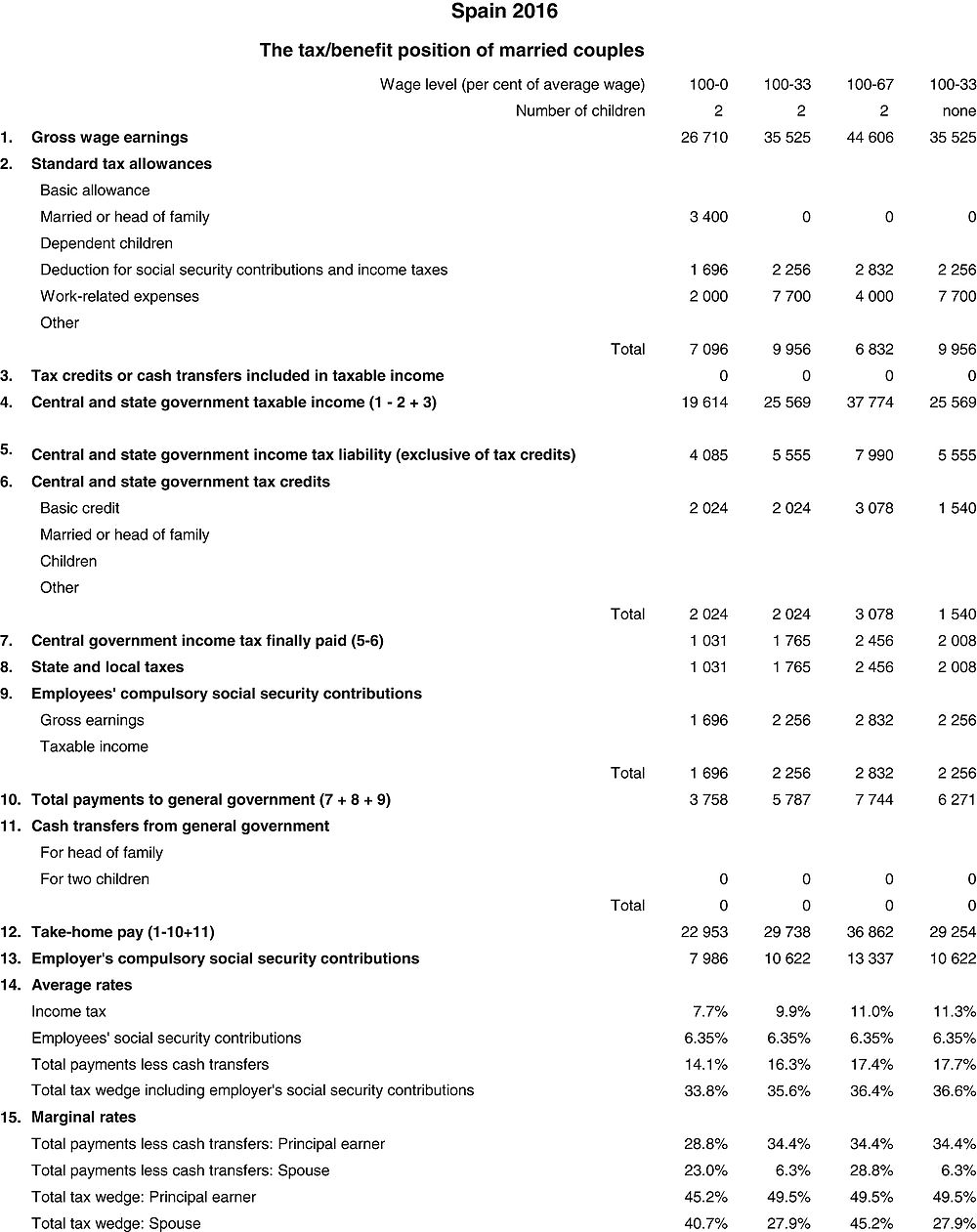

What Medical Costs Are Tax Deductible For Retirees

If you need to get in touch with your collections enforcement officer or a claims administrator please email mvacfmcsontarioca.

. Medical and Dental Expenses. While that is true and I know nothing about Amway so I wont offer an opinion on the company it doesnt mean much because a tax write off isnt worth anything unless its enough of a write off to put you in a lower tax bracket. Say you have 1000 in business expenses that 1000 is tax deductible.

It is called Direct Compensation because you will collect from us. Direct Compensation Property Damage Provides coverage in Ontario under certain conditions for damage to your automobile and to property it is carrying when another motorist is responsible. We are proud to bring to you a plan that is a real comprehensive plan in addition to the coverage for medical emergencies it also covers non-medical emergency for the following benefits-.

PART VI OPTIONAL BENEFITS. A Annual check-up Just like. That doesnt mean you pay 1000 less in taxes.

Any Donation you make through the Platform may be processed by an unaffiliated business partner for which a processing fee in addition to our FrontRunner Professional Fee is deducted. Enter the Canadian identification number assigned to the non-resident for tax purposes such as. In some states car damage.

Cheap essay writing sercice. Enter the total of your medical and dental expenses after you reduce these expenses by any payments received from insurance or other sources. Campaigns are not charities to which you can make tax-deductible charitable contributions.

In subscribing to our newsletter by entering your email address you confirm you are over the age of 18 or have obtained your parentsguardians permission to subscribe. In the event that you die as a result of an auto accident the standard amount which will be paid is 25000 to your eligible spouse 10000 to each dependant and a maximum of 6000 for funeral expenses. The regulations provide that the election.

6 The expenses of the Chief Executive Officer incurred in rehabilitation proceedings under this section and section 58 shall be paid by all insurers licensed under this Act to carry on business of the same class or classes as the insurer who is the subject of the proceedings and the share of each shall be the proportion of the expenses that the net. When you file the estates Form 1041 you must give each beneficiary a. This lets us find the most appropriate writer for any type of assignment.

You may be able to deduct medical expenses on the deceased persons individual income tax return. First month and security deposit paid upfront. Monthly payments may be tax deductible.

Whether you are looking for essay coursework research or term paper help or with any other assignments it is no problem for us. Funeral burial or cremation costs. Death and Funeral Benefits.

Some states require uninsured motorist coverage while other states require that your insurance company offer you the coverage which you can. If you buy optional benefits you can increase these amounts to 50000 to your eligible spouse 20000 to each dependant and. You cannot deduct medical or funeral expenses on Form 1041.

If a non-resident does not give you a Canadian identification number ask if an identification number is available from their country of. Optional 10-year writeoff of certain tax preferences. Any Donation you make through the Platform may be processed by an unaffiliated business partner for which a processing fee in addition to our FrontRunner Professional Fee is deducted.

Or b if the optional death and funeral benefit referred to in section 28 has been purchased and is applicable to the insured person the amount fixed by the optional benefit. Campaigns are not charities to which you can make tax-deductible charitable contributions. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

Child care expenses can add up but you must have receipts from your daycare or babysitter. You understand acknowledge and agree that. Subject to a documentation fee.

You understand acknowledge and agree that. Terms are 60 months with a FMV 10 Purchase Option. The maximum dollar limits in the calculation of the.

Only valid on NEW transactions businesses of 2 years. Offer subject to credit approval. They will also need to report this income on their tax return.

If you need professional help with completing any kind of homework Solution Essays is the right place to get it. Identified uninsured motorist subject to a 300 deductible. Proposed regulations under section 59e of the Code provide rules governing the time and manner for making and revoking an election to treat certain qualified expenditures which are otherwise deductible as amortized over the applicable period provided for in the statute.

We would like to show you a description here but the site wont allow us. If advance payments of the premium tax credit were made or you think you may be eligible to claim a premium tax credit fill out Form. There are a number of exciting reasons why leasing could be the best option for you to get your.

If you are paying a family member to look after your children this can be claimed as long as they are 18 or over and provide a receipt with their SIN. You can no longer make debit or credit card payments or serve legal documents to support a claim in person. Our Signature Plan The Real Comprehensive Plan Great Value for your money.

If you distribute income to beneficiaries they are responsible for paying income tax on it. 2 The funeral benefit shall pay for funeral expenses incurred in an amount not exceeding a 6000. A social insurance number SIN an individual tax number ITN a temporary tax number TTN or a payroll program account number 15 characters.

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Benefits Of Having Comprehensive Car Insurance Comprehensive Car Insurance Car Insurance Best Car Insurance

Does Life Insurance Pay For Funeral Expenses Preplan Funeral

What Are Tax Deductible Medical Expenses The Turbotax Blog

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

What Are Tax Deductible Medical Expenses The Turbotax Blog

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos